Jump into the world of auto quotes where finding the best car insurance deals is made simple. Let’s explore the ins and outs of this essential process.

Discover how to navigate the maze of insurance quotes and secure the best coverage for your vehicle.

Understanding Auto Quotes

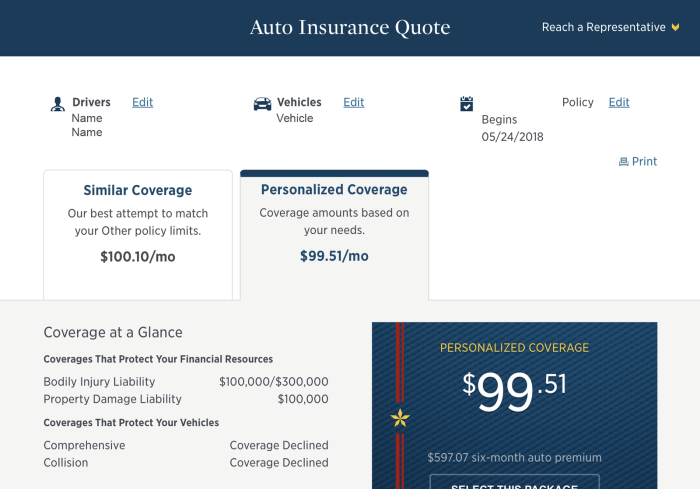

When it comes to insurance, auto quotes refer to the estimated cost of an insurance policy for your vehicle. These quotes are provided by insurance companies based on various factors such as your driving record, the type of car you drive, your age, and the coverage options you choose.Obtaining multiple auto quotes is essential to ensure that you are getting the best possible deal.

By comparing quotes from different insurance companies, you can find a policy that not only fits your budget but also provides adequate coverage for your needs.

Calculation of Auto Quotes

Auto quotes are calculated by insurance companies using a variety of factors to determine the level of risk associated with insuring you and your vehicle. Some common factors that may affect the cost of your auto insurance premium include:

- Your driving record: A history of accidents or traffic violations may result in higher premiums.

- The type of car you drive: The make, model, and age of your vehicle can impact your insurance rates.

- Your age and driving experience: Younger and less experienced drivers typically pay higher premiums.

- The coverage options you choose: The more coverage you opt for, the higher your premium is likely to be.

Insurance companies use complex algorithms to analyze these factors and determine the cost of your auto insurance policy.

Obtaining Auto Quotes

When it comes to obtaining auto quotes, the process has become more convenient with the option to request them online. This allows you to compare different quotes from various insurance providers, helping you make an informed decision.

Requesting Auto Quotes Online

- Visit the websites of different insurance companies or use comparison websites.

- Fill out the required information accurately, including details about your vehicle, driving history, and coverage preferences.

- Submit the form and wait for the quotes to be generated.

- Review the quotes and compare them based on coverage, cost, and additional benefits.

Tips for Comparing Auto Quotes

- Ensure you are comparing quotes with similar coverage options to get an accurate comparison.

- Look for discounts or promotions that can help lower the overall cost.

- Consider the reputation and customer service of the insurance provider.

- Take note of any additional benefits or perks offered by each provider.

Factors Affecting the Accuracy of Auto Quotes

- Driving record: Accurate information about your driving history is crucial for an accurate quote.

- Vehicle details: Providing the correct details about your vehicle, including make, model, and year, can impact the quote.

- Coverage options: The type and amount of coverage you choose will affect the cost of the quote.

- Discount eligibility: Qualifying for discounts based on factors like safe driving habits or multiple policies can lower the quote.

Auto Quotes Comparison

When it comes to getting auto insurance, comparing quotes from different providers is crucial to finding the best coverage at the most competitive rates. This process allows you to assess the various options available to you and make an informed decision based on your needs and budget.

Compare and Contrast Quotes

- Request quotes from multiple insurance companies to compare rates for the same coverage.

- Consider factors such as deductibles, coverage limits, and additional benefits offered by each provider.

- Review the reputation and customer service of the insurance companies to ensure reliability.

Significance of Reviewing Coverage Options

- Understanding the coverage options provided along with the quotes is essential to avoid any surprises in case of an accident or claim.

- Ensure that the coverage aligns with your needs and offers adequate protection for your vehicle.

- Look for any exclusions or limitations in the policy that could affect your decision.

Strategies for Negotiating Better Rates

- Use the quotes received as leverage to negotiate with insurance companies for lower rates or additional discounts.

- Highlight any competitive quotes you have obtained to show that you are actively comparing offers.

- Ask about available discounts or bundling options that could help reduce your premiums.

Auto Quotes Terms and Conditions

When reviewing auto insurance quotes, it’s essential to understand the terms and conditions associated with them. Common terms you’ll encounter include deductible, premium, and coverage limits. Let’s delve into what these terms mean and how they impact your insurance policy.

Deductible

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and file a claim for $2,000 in damages, you would pay the first $500, and your insurance would cover the remaining $1,500.

Premium

Your premium is the amount you pay for your auto insurance coverage. This is typically paid monthly, quarterly, or annually. The premium amount is based on various factors, including your driving record, age, location, and the type of coverage you choose.

Coverage Limits

Coverage limits refer to the maximum amount your insurance company will pay for a covered claim. For example, if you have liability coverage with limits of $50,000/$100,000, this means your insurer will pay up to $50,000 per person injured in an accident, with a maximum of $100,000 per accident for all injuries combined.

Reading the Fine Print

When reviewing auto insurance quotes, it’s crucial to read the fine print carefully. Pay attention to any exclusions, limitations, or additional fees that may not be immediately obvious. Look for details on what is covered, under what circumstances, and any specific conditions that may apply.

Identifying Hidden Costs

Be on the lookout for any hidden costs in auto insurance quotes. These could include fees for processing payments, policy changes, or late payments. Additionally, watch out for exclusions that may not be clearly stated upfront but could significantly impact your coverage when you need to file a claim.

Conclusion

As we wrap up our discussion on auto quotes, remember to always compare, analyze, and negotiate to get the most out of your car insurance. Save smarter and drive safer!