Car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with an informal yet serious tone and brimming with originality from the outset. From understanding the importance of car insurance to exploring tips for saving on premiums, this guide has got you covered.

Importance of Car Insurance

Car insurance is a crucial component for drivers to protect themselves and their vehicles in various situations.

Financial Protection

Having car insurance can save you money in the following situations:

- Accidents: Car insurance can cover the cost of repairs or replacement of your vehicle, as well as medical expenses for injuries sustained in an accident.

- Theft or Vandalism: If your car is stolen or damaged due to vandalism, insurance can help cover the losses.

- Natural Disasters: In the event of a flood, fire, or other natural disasters, car insurance can assist in repairing or replacing your vehicle.

Legal Requirements

Car insurance is a legal requirement in many regions to ensure financial responsibility in case of accidents. It helps protect not only the driver but also other road users in case of any mishaps.

Types of Car Insurance Coverage

When it comes to car insurance, there are several types of coverage options available to protect you and your vehicle in different situations. Let’s explore the various types of car insurance coverage and their benefits.

Liability Insurance

Liability insurance is the most basic type of car insurance coverage and is required by law in most states. It covers damages and injuries that you cause to others in an accident.

- Benefits:

- Provides financial protection in case you are at fault in an accident

- Covers legal fees if you are sued

Example: If you rear-end another car and the driver sustains injuries, liability insurance will cover their medical expenses.

Comprehensive Insurance

Comprehensive insurance covers damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters.

- Benefits:

- Protects your vehicle from non-collision related incidents

- Covers the cost of repairs or replacement of your vehicle

Example: If a tree falls on your car during a storm, comprehensive insurance will cover the cost of repairs.

Collision Insurance

Collision insurance covers damage to your vehicle in the event of a collision with another vehicle or object.

- Benefits:

- Pays for repairs to your vehicle after a collision

- Covers replacement costs if your car is totaled in an accident

Example: If you hit a guardrail and damage the front of your car, collision insurance will cover the repair costs.

Factors Affecting Car Insurance Rates

When it comes to determining car insurance rates, several factors come into play. These factors can significantly impact how much you pay for your car insurance premiums. Let’s take a closer look at some of the key elements that influence car insurance rates.

Personal Factors

- Age: Younger drivers under 25 and older drivers over 65 tend to pay higher premiums due to a higher risk of accidents.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance rates.

- Location: Urban areas with higher traffic congestion and crime rates may result in higher insurance premiums.

Type of Car

- Make and Model: Luxury or sports cars usually have higher insurance rates due to higher repair costs.

- Safety Features: Cars equipped with advanced safety features like anti-theft devices may qualify for discounts.

Mileage and Coverage Limits

- Mileage: The more you drive, the higher the risk of accidents, which can lead to higher insurance premiums.

- Coverage Limits: Opting for higher coverage limits can increase your premiums but provide better financial protection in case of an accident.

Tips for Saving on Car Insurance

When it comes to car insurance, finding ways to save money on premiums is always a top priority for drivers. By following some key strategies and taking advantage of available discounts, you can lower your car insurance costs and get the coverage you need at a more affordable rate.

Increase Your Deductible

One effective way to lower your car insurance premiums is to increase your deductible. By opting for a higher deductible amount, you can reduce the overall cost of your insurance policy. Just make sure you have enough savings set aside to cover the deductible in case of an accident.

Bundle Your Policies

Many insurance companies offer discounts for bundling multiple policies, such as car insurance and homeowners or renters insurance. By combining your insurance policies with one provider, you can often qualify for significant savings on your premiums.

Maintain a Good Driving Record

One of the best ways to qualify for discounts on car insurance is to maintain a clean driving record. Avoiding accidents and traffic violations can help you secure lower rates from insurance companies. Safe driving habits can not only keep you safe on the road but also save you money on insurance premiums.

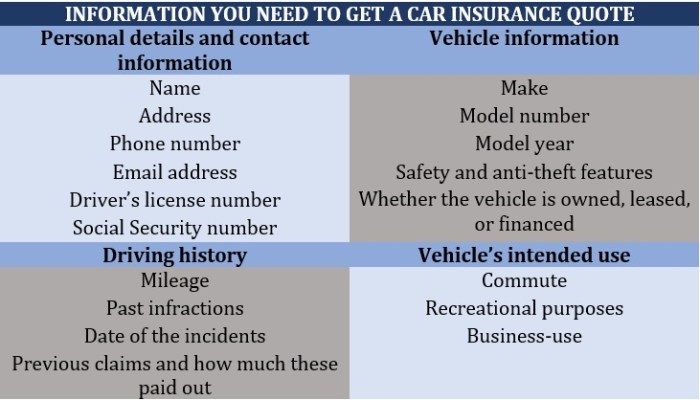

Shop Around and Compare Quotes

Finally, one of the most important tips for saving on car insurance is to shop around and compare quotes from different insurers. Rates can vary significantly between insurance companies, so it’s essential to get quotes from multiple providers to find the best deal. Don’t settle for the first quote you receive – take the time to compare options and choose the policy that offers the coverage you need at the most competitive price.

Ending Remarks

As we conclude this comprehensive guide on car insurance, remember that being informed and proactive is key to securing the best coverage at the right price. With the knowledge gained here, you’re now equipped to navigate the world of car insurance with confidence and savvy.