Delve into the world of car insurance quotes as we uncover the importance, factors influencing costs, how to obtain quotes, and understanding coverage options. Get ready for a comprehensive guide that will empower you in making informed decisions.

Importance of Car Insurance Quotes

Car insurance quotes play a crucial role in helping drivers protect themselves and their vehicles on the road. By obtaining and comparing quotes from different insurance providers, drivers can make informed decisions and choose the coverage that best suits their needs and budget.

Factors Affecting Car Insurance Quotes

Car insurance quotes can vary significantly based on several factors, including:

- Age: Younger drivers typically face higher insurance premiums due to their lack of driving experience.

- Driving History: Drivers with a history of accidents or traffic violations may receive higher quotes as they are considered higher risk.

- Type of Vehicle: The make, model, and age of the vehicle can also impact insurance quotes, with newer or more expensive cars often resulting in higher premiums.

Factors Influencing Car Insurance Quotes

When it comes to car insurance quotes, several factors play a significant role in determining the cost. Understanding these factors can help you make informed decisions when choosing an insurance policy that fits your needs and budget.

Driver’s Age

The age of the driver is a crucial factor that insurance companies consider when providing quotes. Younger drivers, especially those under the age of 25, are typically charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older and more experienced drivers usually receive lower insurance quotes.

Make and Model of Vehicle

The make and model of the vehicle you drive also impact the cost of your insurance quotes. Cars that are more expensive to repair or replace, as well as those with higher horsepower or classified as sports cars, generally have higher insurance premiums. On the other hand, vehicles with advanced safety features and good crash test ratings may qualify for discounts on insurance quotes.

Driving History, Location, and Coverage Options

Your driving history, including any past accidents or traffic violations, can significantly influence your car insurance quotes. Drivers with a clean record are often eligible for lower premiums compared to those with a history of accidents. Additionally, your location plays a role in insurance costs, as areas with higher rates of accidents or theft may result in higher premiums. Lastly, the coverage options you choose, such as liability, collision, and comprehensive coverage, will also impact your insurance quotes.

Obtaining Car Insurance Quotes

When it comes to getting car insurance quotes, there are several methods you can use to ensure you are making an informed decision. It is crucial to obtain multiple quotes to compare prices and coverage options. Here are some ways to obtain car insurance quotes:

Online

- One of the most convenient ways to get car insurance quotes is by using online platforms provided by insurance companies. You can easily enter your information, including your vehicle details and driving history, to receive quotes instantly.

- Online comparison websites can also be a valuable tool to compare quotes from multiple insurance providers at once. These websites allow you to input your information only once and receive quotes from various companies.

Through Agents

- Another way to obtain car insurance quotes is by contacting insurance agents directly. Agents can provide personalized quotes based on your specific needs and can help you understand the coverage options available.

- Speaking with an agent can also give you the opportunity to ask questions and clarify any doubts you may have about the policy.

Importance of Providing Accurate Information

It is essential to provide accurate information when requesting car insurance quotes to ensure that the quotes you receive are as close to the actual cost as possible. Inaccurate information can lead to incorrect quotes and may result in issues when filing claims in the future. Be honest and transparent when providing details about your driving history, vehicle information, and personal details.

Comparing Multiple Car Insurance Quotes

- Once you have gathered multiple car insurance quotes, take the time to compare them carefully. Look not only at the price but also at the coverage options, deductibles, and exclusions included in each policy.

- Consider factors such as the reputation of the insurance company, customer reviews, and the ease of filing claims when comparing quotes.

- Remember that the cheapest quote may not always be the best option, so weigh all aspects of the policy before making a decision.

Understanding Car Insurance Coverage

When it comes to car insurance, understanding the different types of coverage included in your policy is crucial. Each type of coverage serves a specific purpose and knowing what they entail can help you make informed decisions about your insurance needs.

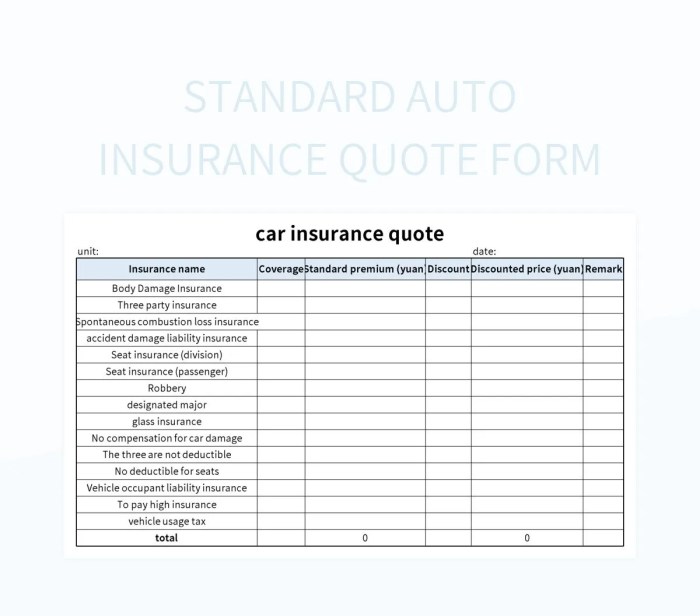

Types of Coverage Included in Car Insurance Quotes

Car insurance quotes typically include the following types of coverage:

- Liability Coverage: This covers damages and injuries you are legally responsible for in an accident.

- Collision Coverage: This pays for damages to your own vehicle in the event of a collision with another car or object.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This protects you in case you’re involved in an accident with a driver who has insufficient or no insurance.

Importance of Understanding Coverage Terms and Conditions

It’s essential to understand the terms and conditions of each coverage type because it can impact your financial responsibility in various situations. For example, knowing the limits of your liability coverage can help you avoid out-of-pocket expenses if your coverage falls short in a severe accident.

Scenarios Where Different Coverage Options Come into Play

For instance, if you’re involved in a collision with another vehicle, your collision coverage would kick in to cover the damages to your car. On the other hand, if your car is stolen or damaged in a storm, comprehensive coverage would provide the necessary protection.

Final Thoughts

Explore the realm of car insurance quotes with newfound knowledge and confidence. From understanding the intricacies of quotes to comparing options, you’re now equipped to navigate the world of car insurance with ease.