Starting off with carinsurancequotes, this guide will delve into the intricacies of car insurance quotes, helping you navigate the complexities and make informed decisions.

As we explore the different types of coverage, factors influencing quotes, and tips for saving money, you’ll gain a comprehensive understanding of car insurance quotes.

Understanding Car Insurance Quotes

Car insurance quotes are estimates provided by insurance companies that detail the cost of insuring a specific vehicle based on various factors. These quotes are essential for individuals looking to purchase car insurance as they help in comparing different options and selecting the most suitable coverage.

Calculation of Car Insurance Quotes

Car insurance quotes are calculated based on several factors, including the driver’s age, driving record, location, type of vehicle, coverage limits, and deductibles. Insurance companies use statistical data and risk assessment models to determine the likelihood of a driver filing a claim and adjust the premium accordingly. Additionally, factors such as the frequency of accidents in a particular area, the vehicle’s safety features, and the driver’s credit score can also influence the final quote.

Factors Influencing Car Insurance Quotes

- Driver’s Age: Younger and inexperienced drivers typically face higher insurance premiums due to their increased risk of accidents.

- Driving Record: A history of accidents or traffic violations can result in higher insurance rates as it indicates a higher risk for the insurance company.

- Location: Urban areas with higher rates of accidents or vehicle theft may lead to higher insurance quotes compared to rural areas.

- Type of Vehicle: The make and model of the vehicle, as well as its safety features, can impact insurance rates. Sports cars or luxury vehicles may have higher premiums.

- Coverage Limits and Deductibles: Opting for higher coverage limits or lower deductibles can increase the insurance premium.

Types of Coverage in Car Insurance Quotes

When getting car insurance quotes, it’s essential to understand the different types of coverage included. Each type serves a specific purpose in protecting you and your vehicle in various situations.

Liability Coverage

Liability coverage is mandatory in most states and covers the costs if you’re responsible for injuring someone or damaging their property in an accident. It includes bodily injury liability and property damage liability.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle after a collision with another vehicle or object, regardless of fault. It is optional but can be valuable in ensuring your car is repaired or replaced.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage not caused by a collision, such as theft, vandalism, or natural disasters. It also covers windshield damage and hitting an animal on the road.Each type of coverage plays a crucial role in safeguarding you financially in different scenarios. While liability coverage is required by law, collision and comprehensive coverage provide added protection for your vehicle.

When getting car insurance quotes, it’s essential to consider the importance of each type of coverage based on your needs and budget.

Obtaining Car Insurance Quotes

When it comes to getting car insurance quotes, there are a few key steps to follow to ensure you are making an informed decision. Here’s a breakdown of the process:

Comparing Quotes from Different Insurance Providers

It’s essential to obtain quotes from multiple insurance providers to get a comprehensive view of the options available to you. Here are some tips on how to compare quotes effectively:

- Request quotes for the same coverage limits and deductibles to make an accurate comparison.

- Consider the reputation and financial stability of the insurance companies providing the quotes.

- Look for any discounts or special offers that may apply to your situation.

- Review the details of each quote, including coverage types and limits, to ensure they meet your needs.

- Don’t focus solely on the price; consider the level of customer service and claims handling offered by each provider.

Significance of Accuracy When Providing Information for a Quote

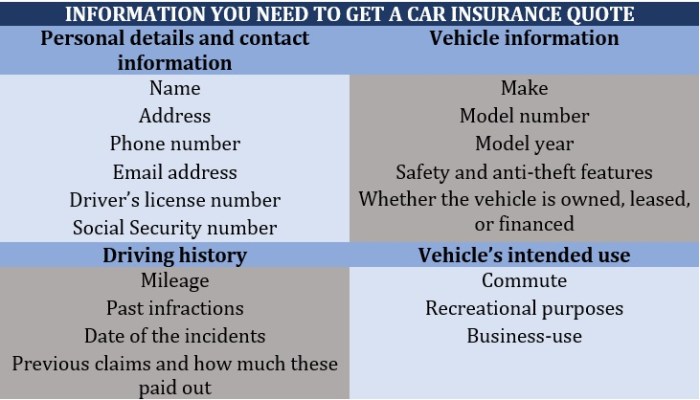

When requesting car insurance quotes, accuracy is crucial to ensure you receive an accurate estimate of the cost. Here’s why providing precise information is essential:

- Incorrect information can lead to inaccurate quotes, resulting in unexpected costs or coverage gaps.

- Insurance companies use the details you provide to determine your risk level and calculate premiums.

- Be honest about your driving record, vehicle details, and other relevant information to avoid issues in the future.

- Double-check all the information you provide to ensure there are no mistakes that could impact the accuracy of the quote.

Factors Influencing Car Insurance Quotes

When it comes to determining car insurance quotes, several factors come into play that can significantly impact the premiums you pay. Factors such as age, driving history, type of vehicle, location, and credit score all play a crucial role in determining how much you will pay for car insurance.

Age

Age is a key factor that insurance companies consider when calculating car insurance quotes. Younger drivers, especially teenagers, are often charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers may also face higher premiums as they are considered more prone to accidents.

Driving History

Your driving history, including any past traffic violations, accidents, or claims, can significantly impact your car insurance quotes. Drivers with a clean record are likely to receive lower premiums, while those with a history of accidents or traffic violations may face higher rates.

Type of Vehicle

The type of vehicle you drive also plays a role in determining your car insurance quotes. Luxury cars, sports cars, and vehicles with high theft rates or expensive repair costs typically result in higher premiums. On the other hand, driving a safe, reliable vehicle with good safety features can lead to lower insurance rates.

Location and Credit Score

Your location and credit score can also influence the cost of your car insurance. Drivers living in urban areas or areas with high crime rates may face higher premiums due to increased risk of accidents or theft. Additionally, drivers with poor credit scores may be charged higher rates as they are considered higher risk by insurance companies.

Examples of Impact

For example, a 25-year-old driver with a clean record driving a sedan in a low-crime area may receive lower insurance quotes compared to an 18-year-old driver with a history of accidents driving a sports car in a high-crime area. Similarly, a driver with an excellent credit score may receive lower premiums than a driver with a poor credit score, even if their driving history is similar.

Tips for Saving Money on Car Insurance Quotes

When it comes to saving money on car insurance quotes, there are several strategies you can consider to lower your premiums and get the best possible deal.

Bundling Policies for Potential Savings

One effective way to save money on car insurance is by bundling your policies. This means purchasing multiple types of insurance, such as auto and home insurance, from the same provider. By bundling your policies, you may be eligible for a discount on your overall premium, resulting in significant savings in the long run.

Maintaining a Good Driving Record

Another key factor that can positively impact your insurance costs is maintaining a good driving record. Insurance companies often offer lower premiums to drivers with clean records, as they are considered less risky to insure. By following traffic laws, avoiding accidents, and practicing safe driving habits, you can demonstrate to insurance providers that you are a responsible driver, potentially leading to lower insurance rates.

Ending Remarks

In conclusion, mastering the world of car insurance quotes is key to securing the right coverage at the best price. Use the insights gained here to make smart choices and save money on your car insurance.