Looking for the best deal on car insurance? Dive into the world of cheap free car insurance quotes and discover how to save big while getting the coverage you need.

Understanding the factors that influence quotes, how to obtain them, and the benefits and risks involved will help you make an informed decision.

Understanding Cheap Free Car Insurance Quote

When it comes to car insurance, getting a cheap free car insurance quote is a common practice among individuals looking to save money on their premiums. A cheap free car insurance quote refers to an estimate of the cost of insurance coverage for your vehicle that is provided to you at no charge.

Why Individuals Seek Cheap Free Car Insurance Quotes

Seeking out cheap free car insurance quotes allows individuals to compare different insurance providers and their rates to find the most affordable option that meets their needs. By obtaining multiple quotes, drivers can ensure they are not overpaying for coverage and can potentially save money on their premiums.

How to Differentiate Between Legitimate and Scam Insurance Quotes

- Legitimate insurance quotes are typically provided by reputable insurance companies with a known track record in the industry. Be wary of quotes that seem too good to be true or are significantly lower than other quotes you have received.

- Scam insurance quotes may come from unknown or unlicensed companies, often promising extremely low rates or requiring payment upfront before providing any details. Always research the insurance provider and verify their credentials before accepting a quote.

- Look out for red flags such as spelling errors, unprofessional communication, or pressure tactics to make a quick decision. Legitimate insurance companies will provide transparent information and give you time to review and compare quotes.

Factors Affecting Cheap Free Car Insurance Quotes

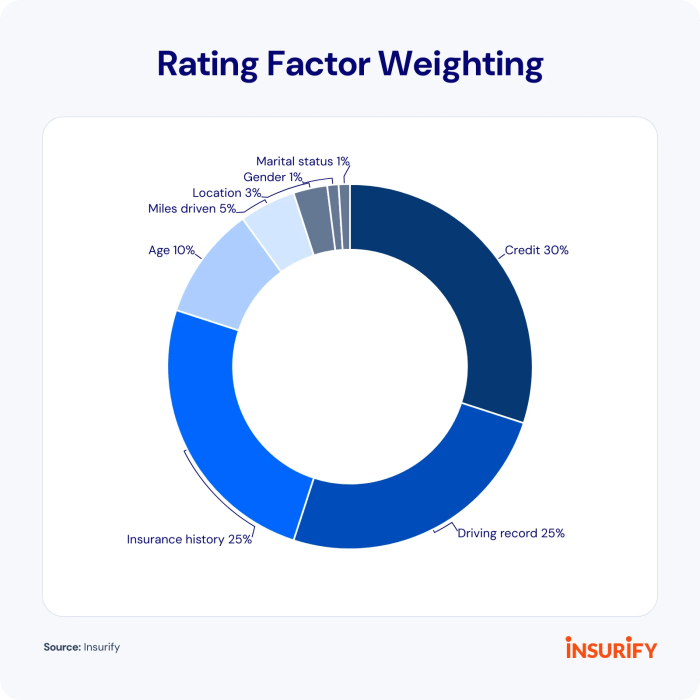

When it comes to determining the cost of car insurance, there are several factors that insurance companies consider. These factors can vary depending on the individual, the vehicle, and other circumstances. Understanding these factors can help you navigate the process of obtaining a cheap free car insurance quote.

Driving Record

Having a clean driving record is one of the most significant factors that can influence your car insurance quote. If you have a history of accidents or traffic violations, insurance companies may consider you to be a higher risk driver, resulting in higher premiums.

Age and Gender

Age and gender also play a role in determining car insurance rates. Young drivers, especially teenagers, are often charged higher premiums due to their lack of experience on the road. Additionally, statistics show that young male drivers are more likely to be involved in accidents, leading to higher insurance costs compared to their female counterparts.

Type of Vehicle

The type of vehicle you drive can impact your insurance quote as well. Insurance companies take into account the make and model of your car, as well as its age and safety features. Generally, newer and safer vehicles may qualify for lower insurance rates compared to older or high-performance cars.

Location

Where you live can also affect your car insurance premium. Urban areas with higher rates of accidents or theft may result in higher insurance costs compared to rural areas. Additionally, specific zip codes may have different insurance requirements or regulations, impacting the overall price.

Credit Score

Believe it or not, your credit score can influence your car insurance rates. Insurance companies may use your credit history to determine your level of financial responsibility, with better credit scores often resulting in lower premiums.

How to Obtain Cheap Free Car Insurance Quotes

When looking for cheap free car insurance quotes, the process can be streamlined by following these steps:

Requesting and Comparing Quotes Online

- Start by visiting reputable insurance comparison websites or the official websites of insurance companies.

- Fill out the required information accurately, including details about your vehicle, driving history, and coverage preferences.

- Submit the form to receive quotes from multiple providers for easy comparison.

- Review the quotes carefully, considering not only the premium cost but also the coverage limits and deductibles offered.

- Select the quote that best fits your needs and budget.

Importance of Providing Accurate Information

- Ensure that all information provided is accurate and up-to-date to receive the most precise quotes.

- Inaccurate information can result in quotes that do not reflect the actual cost of insurance, leading to surprises later on.

- Be honest about your driving history, vehicle details, and personal information to get the most accurate quotes.

Tips on Negotiating for Lower Insurance Premiums

- After receiving quotes, consider contacting the insurance companies directly to negotiate for lower premiums.

- Highlight any discounts you may qualify for, such as safe driver discounts or bundling policies.

- Ask about available discounts or ways to lower the premium without compromising coverage.

- Compare the quotes received to leverage better deals and negotiate effectively for affordable insurance.

Benefits and Risks of Opting for the Cheapest Insurance Quote

When it comes to selecting a car insurance policy, opting for the cheapest insurance quote can have both advantages and risks. It is crucial to understand the balance between affordability and coverage to make an informed decision.

Advantages of Choosing a Cheap Insurance Quote

- Cost savings: One of the most significant benefits of opting for a cheap insurance quote is the cost savings it offers. By choosing a budget-friendly policy, you can lower your monthly expenses and allocate your funds to other essential areas.

- Basic coverage: While cheap insurance quotes may not offer comprehensive coverage, they typically provide the minimum legal requirements. This ensures that you meet the necessary insurance standards without breaking the bank.

- Accessibility: Cheap insurance quotes are often more accessible to individuals with limited financial resources. They provide an entry point for those who need basic coverage but cannot afford higher premiums.

Potential Risks of Opting for the Cheapest Insurance Quote

- Lack of coverage: The primary risk associated with choosing a cheap insurance quote is the limited coverage it offers. In the event of an accident or damage to your vehicle, you may find yourself underinsured and responsible for significant out-of-pocket expenses.

- Higher deductibles: Cheap insurance quotes often come with higher deductibles, meaning you will have to pay more out of pocket before the insurance coverage kicks in. This can be a financial burden, especially in emergencies.

- Poor customer service: Some budget insurance providers may compromise on customer service quality to keep costs low. This could result in delays in claims processing, difficulty in reaching customer support, or lack of assistance when needed.

Striking a Balance Between Affordability and Coverage

- Compare quotes: To strike a balance between affordability and coverage, it is essential to compare multiple insurance quotes from different providers. Look for policies that offer a reasonable premium with adequate coverage for your needs.

- Consider your risk tolerance: Evaluate your risk tolerance level and financial capabilities before opting for the cheapest insurance quote. Balancing your budget constraints with the level of coverage you require is key to making the right decision.

- Review policy details: Carefully review the policy details, including coverage limits, deductibles, and exclusions, before finalizing your decision. Ensure that the insurance policy aligns with your expectations and provides the necessary protection.

Epilogue

Don’t miss out on the opportunity to secure affordable car insurance. By weighing the benefits and risks, you can find the perfect balance between cost and coverage.