When it comes to cheap liability only insurance, understanding the ins and outs is crucial. Let’s dive into this cost-effective coverage option and explore how you can secure the protection you need without breaking the bank.

From defining liability only insurance to uncovering the factors that influence its cost, this guide will equip you with the knowledge to make informed decisions about your insurance needs.

Understanding Cheap Liability Only Insurance

Liability only insurance is a type of car insurance that provides coverage for damages or injuries you cause to others in an accident. It does not cover damages to your own vehicle.

Cheap liability only insurance refers to a basic and more affordable insurance option that meets the legal requirements for liability coverage. This type of insurance is often chosen by drivers who have older vehicles or limited financial means.

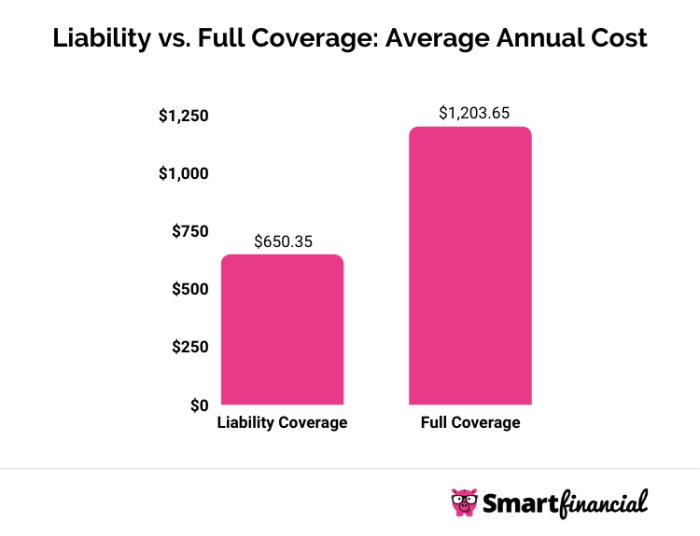

Comparison with Full Coverage

- Cheap liability only insurance is typically less expensive than full coverage insurance.

- Full coverage insurance provides broader protection for your vehicle but comes at a higher cost.

- Cheap liability only insurance may be suitable for drivers with older cars or those looking to save money on premiums.

- Full coverage insurance is recommended for newer vehicles or drivers who want more comprehensive protection.

Full coverage insurance, on the other hand, includes liability coverage as well as coverage for damage to your own vehicle in addition to other benefits like comprehensive and collision coverage.

Factors Affecting Cost of Liability Only Insurance

When it comes to determining the cost of liability only insurance, there are several factors that come into play. Understanding these factors can help you make informed decisions when choosing your coverage.

Driving Record

Your driving record is a significant factor in determining the cost of liability only insurance. Insurance companies assess your driving history to evaluate the level of risk you pose as a driver. A clean driving record with no accidents or traffic violations usually results in lower premiums. On the other hand, a history of accidents or tickets can lead to higher insurance rates.

Type of Vehicle

The type of vehicle you drive also influences the price of liability only insurance. Insurance companies consider factors such as the make and model of your car, its age, safety features, and likelihood of theft when calculating premiums. Generally, newer and more expensive vehicles will cost more to insure due to the higher cost of repairs or replacements in case of an accident.

Where to Find Cheap Liability Only Insurance

When looking for affordable liability only insurance, it is important to explore different insurance companies and compare quotes to ensure you are getting the best rates possible.

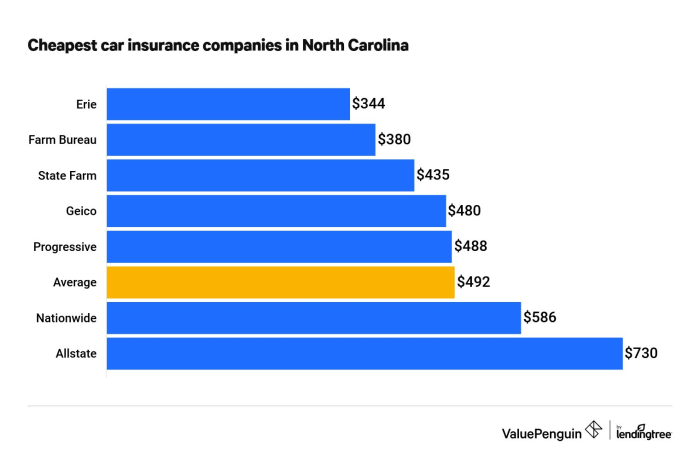

List of Insurance Companies Offering Affordable Liability Only Coverage

- GEICO

- Progressive

- Allstate

- State Farm

- Farmers Insurance

Online Resources for Comparing Quotes

- Insurance comparison websites like Compare.com and The Zebra

- Insurance company websites that allow you to get quotes online

- Mobile apps that specialize in providing insurance quotes

Importance of Shopping Around for the Best Rates

It is crucial to shop around for the best rates when looking for cheap liability only insurance. By comparing quotes from different insurance companies, you can ensure that you are getting the most affordable coverage that meets your needs. Don’t settle for the first quote you receive, as rates can vary significantly between providers.

Tips for Getting Cheap Liability Only Insurance

When it comes to getting cheap liability only insurance, there are several strategies you can use to lower your premiums and save money. One of the key ways to achieve this is by understanding the factors that affect the cost of insurance and taking advantage of them to your benefit.

Benefits of Bundling Policies

- One effective way to lower your insurance premiums is by bundling your policies. This means purchasing multiple insurance policies from the same provider, such as auto insurance and homeowners insurance, together.

- Insurance companies often offer discounts to customers who bundle their policies, as it encourages loyalty and reduces administrative costs for the provider.

- By bundling your policies, you can potentially save a significant amount of money on your insurance premiums while still maintaining adequate coverage.

Impact of Increasing Deductibles on the Cost

- Another way to reduce the cost of liability only insurance is by increasing your deductibles. Deductibles are the amount of money you agree to pay out of pocket before your insurance coverage kicks in.

- By opting for a higher deductible, you can lower your monthly premiums. However, it’s important to ensure that you can afford the higher out-of-pocket costs in the event of a claim.

- Increasing your deductibles can be a cost-effective strategy for getting cheap liability only insurance, but it’s essential to weigh the potential savings against the financial risk.

Concluding Remarks

As we wrap up our discussion on cheap liability only insurance, remember that affordability doesn’t have to mean compromising on quality. By following the tips and insights shared here, you can navigate the insurance landscape with confidence and find the coverage that fits your budget and needs.