When it comes to finding the most budget-friendly vehicle insurance, navigating through the myriad of options can be overwhelming. Let’s delve into the world of cheapest vehicle insurance, exploring key factors, discounts, and tips to help you secure the best deal possible.

From understanding the various coverage options to uncovering hidden savings opportunities, this comprehensive guide will equip you with the knowledge needed to make informed decisions and lower your insurance costs.

Researching the Cheapest Vehicle Insurance Options

When looking for the cheapest vehicle insurance options, it is essential to consider various factors that influence the cost of insurance. Understanding the different types of coverage available and how they impact insurance costs can help you make informed decisions. Additionally, comparing insurance quotes effectively and considering deductible amounts are crucial steps in finding affordable insurance.

Key Factors Influencing Insurance Costs

- Driving Record: A clean driving record typically results in lower insurance premiums, as it indicates a lower risk for the insurance company.

- Vehicle Type: The make and model of your vehicle can impact insurance costs, with more expensive or high-performance vehicles often leading to higher premiums.

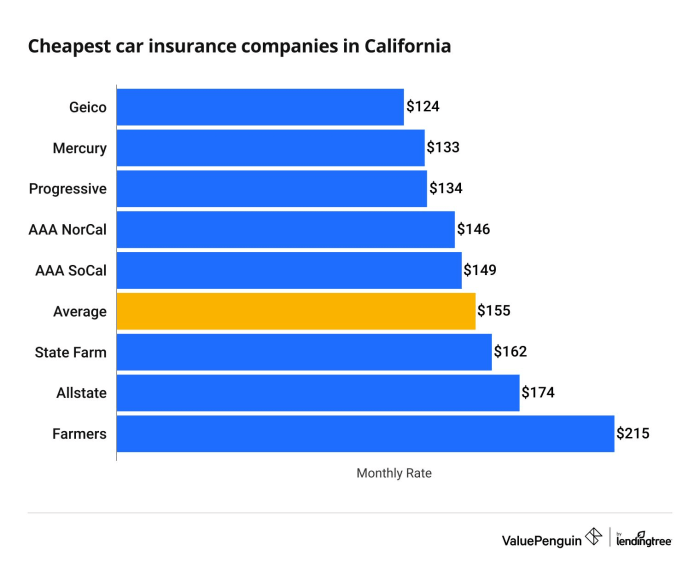

- Location: Where you live can affect insurance rates, as areas with higher rates of accidents or theft may result in higher premiums.

- Coverage Options: The type and amount of coverage you choose will directly impact your insurance costs.

Types of Coverage and Their Impact

- Liability Coverage: This type of coverage helps pay for damages and injuries you cause to others in an accident. It is typically required by law and can impact your insurance costs significantly.

- Comprehensive Coverage: This coverage helps pay for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Collision Coverage: Collision coverage helps pay for damages to your vehicle in the event of a collision with another vehicle or object.

Strategies to Compare Insurance Quotes

- Get Multiple Quotes: Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Review Coverage Limits: Make sure you are comparing quotes with similar coverage limits to get an accurate comparison.

- Consider Discounts: Insurance companies offer various discounts that can help lower your premiums, so make sure to inquire about any available discounts.

Importance of Considering Deductible Amounts

- A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it is essential to consider whether you can afford the deductible in the event of a claim.

- By balancing your deductible amount with your monthly premium, you can find a cost-effective insurance option that provides the coverage you need.

Understanding Discounts and Savings Opportunities

When it comes to reducing the cost of your vehicle insurance, taking advantage of discounts and savings opportunities can make a significant difference in your premiums. Understanding the various discounts offered by insurance companies and how you can qualify for them is key to saving money on your policy.

Common Discounts Offered

- Multi-policy discount: Insuring multiple vehicles or bundling your auto insurance with other policies like homeowners or renters insurance can lead to a discount on your premiums.

- Safe driver discount: Maintaining a clean driving record free of accidents or traffic violations can often earn you a discount on your insurance.

- Good student discount: If you are a student with good grades, you may qualify for a discount on your auto insurance.

Criteria for Qualifying for Discounts

- Multi-policy discount: You usually need to insure more than one vehicle or have multiple policies with the same insurance company to qualify.

- Safe driver discount: Typically, you need to have a clean driving record for a certain period, usually three to five years, to be eligible for this discount.

- Good student discount: Generally, you need to maintain a certain GPA, usually a B average or higher, to qualify for this discount.

Lesser-known Ways to Save

- Pay in full: Some insurance companies offer a discount if you pay your premium in full upfront rather than in monthly installments.

- Low mileage discount: If you don’t drive your vehicle frequently, you may be eligible for a discount based on the number of miles you drive annually.

Impact of Bundling Policies

Bundling your auto insurance with other policies like homeowners or renters insurance can often result in a significant discount on your premiums. Insurance companies value customer loyalty and are willing to offer discounts to customers who choose to bundle multiple policies with them.

Factors Affecting Insurance Costs

When it comes to determining insurance premiums, several factors play a crucial role in influencing the costs. Let’s delve into some of the key factors that can affect how much you pay for your vehicle insurance.

Driver’s Age and Driving Record

The driver’s age and driving record are significant factors that insurance companies consider when calculating premiums. Younger and inexperienced drivers typically face higher insurance rates due to their higher risk of being involved in accidents. On the other hand, older and more experienced drivers with a clean driving record are deemed less risky, resulting in lower insurance costs.

Make and Model of Vehicle

The make and model of the vehicle also play a vital role in determining insurance rates. High-performance cars or luxury vehicles are often more expensive to insure due to their higher repair costs and likelihood of theft. On the contrary, economy cars or vehicles with advanced safety features may result in lower insurance premiums.

Location and Annual Mileage

Where you live and how much you drive can impact your insurance costs. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas. Additionally, the more miles you drive annually, the higher the risk of being involved in an accident, which can lead to increased insurance rates.

Adding Safety Features to a Vehicle

Adding safety features to your vehicle can lead to savings on insurance premiums. Features such as anti-theft devices, airbags, and advanced driver assistance systems can reduce the risk of accidents or theft, making your vehicle less risky to insure. Insurance companies often offer discounts for vehicles equipped with these safety features.

Tips for Lowering Vehicle Insurance Premiums

Lowering your vehicle insurance premiums can help you save money in the long run. Here are some tips to help you negotiate better rates, maintain a good credit score, attend defensive driving courses, and periodically review your coverage.

Negotiating with Insurance Providers

When it comes to negotiating with insurance providers, it’s essential to shop around and compare quotes from different companies. You can also consider bundling your policies, increasing your deductibles, and asking about available discounts.

Maintaining a Good Credit Score

Your credit score can have a significant impact on your insurance premiums. By maintaining a good credit score, you may be eligible for lower rates. Make sure to pay your bills on time, keep your credit card balances low, and monitor your credit report regularly.

Attending Defensive Driving Courses

Attending defensive driving courses can help you become a safer driver and potentially reduce your insurance costs. Some insurance companies offer discounts to drivers who complete these courses. Check with your provider to see if this option is available to you.

Reviewing and Adjusting Coverage

It’s important to periodically review your insurance coverage to ensure it meets your current needs. You may be able to adjust your coverage levels, remove unnecessary add-ons, or switch to a different plan that offers better rates. Don’t hesitate to reach out to your insurance agent for guidance.

Outcome Summary

As you embark on your journey to secure the cheapest vehicle insurance, remember to leverage discounts, consider all influencing factors, and continually review your coverage to ensure you’re getting the best value for your money. By implementing the strategies Artikeld in this guide, you’ll be well on your way to enjoying significant savings on your insurance premiums.