Ready to navigate the world of auto insurance? Dive into our guide on comparing auto insurance policies, understanding rates, choosing the right company, and maximizing savings. Get ready for a rollercoaster ride of insights!

Types of Auto Insurance

When it comes to auto insurance, there are several types of policies available in the market, each offering different levels of coverage to suit various needs. It’s essential to understand the differences between these types to ensure you have the right protection for your vehicle.

Liability Insurance

Liability insurance is the most basic type of auto insurance required in most states. It covers damages and injuries to other people in accidents where you are at fault. This type of coverage does not pay for your vehicle’s damages or medical expenses.

Comprehensive Insurance

Comprehensive insurance provides coverage for damages to your vehicle not caused by a collision, such as theft, vandalism, fire, or natural disasters. It offers protection for a wide range of incidents beyond accidents.

Collision Insurance

Collision insurance covers damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault. This type of coverage is essential for repairing or replacing your car after an accident.

Full Coverage Insurance

Full coverage insurance combines liability, comprehensive, and collision coverage to provide a comprehensive level of protection for your vehicle. While it offers more extensive coverage, it also comes with higher premiums.

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, insurance companies take several factors into consideration to assess the level of risk associated with insuring a driver. These factors play a significant role in determining the premium that a driver will pay for their coverage.

Age

Age is a key factor that insurance companies consider when calculating auto insurance rates. Younger drivers, especially teenagers, are typically charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers may also face higher rates as they are statistically more prone to accidents as they age.

Driving Record

A driver’s driving record is another crucial factor that influences auto insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums, while a history of accidents, speeding tickets, or DUIs can lead to increased rates.

Location

The location where a driver resides also impacts auto insurance rates. Urban areas with higher population densities tend to have more traffic congestion and a greater risk of accidents, leading to higher premiums. Additionally, areas prone to theft or vandalism may result in increased rates.

Type of Vehicle

The type of vehicle being insured is another factor that insurance companies take into account. Cars with high safety ratings and features are typically cheaper to insure, while luxury vehicles or sports cars may come with higher premiums due to their higher repair costs and increased likelihood of theft.

Coverage Options

The coverage options selected by a driver also influence auto insurance rates. Opting for comprehensive coverage with higher limits and lower deductibles will result in higher premiums, while choosing basic coverage with minimal protection will lead to lower rates.By understanding these factors affecting auto insurance rates, drivers can take steps to potentially lower their premiums. Maintaining a clean driving record, choosing a safe vehicle, and selecting coverage options carefully can all contribute to reducing insurance costs.

Comparing Auto Insurance Companies

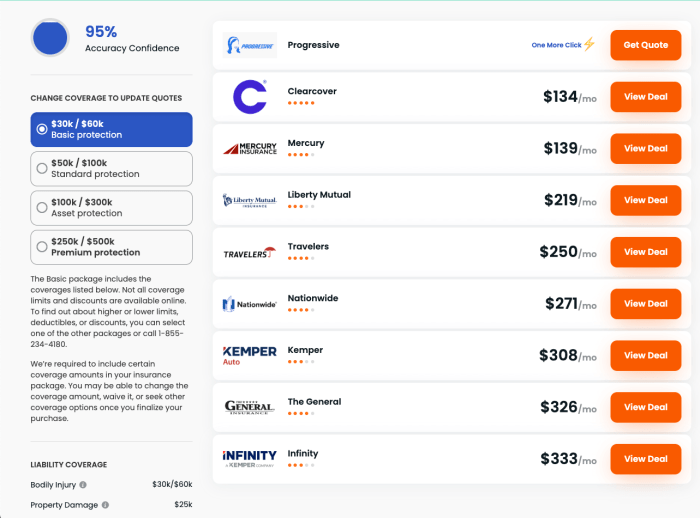

When comparing auto insurance companies, it’s important to consider various factors such as customer reviews, coverage options, pricing, customer service, and claims handling. Finding the right insurance provider can make a significant difference in both cost and overall satisfaction.

Popular Auto Insurance Companies Comparison

- State Farm: Known for its personalized service and wide range of coverage options, State Farm is a popular choice for many drivers. Customers often praise the company’s responsive claims handling.

- Geico: Geico is well-known for its competitive pricing and user-friendly online tools. Customers appreciate the ease of managing their policies and filing claims.

- Progressive: Progressive offers a variety of discounts and innovative services such as Snapshot, which tracks driving habits to potentially lower rates. Customers value the company’s flexible options.

- Allstate: Allstate is recognized for its comprehensive coverage options and strong customer service. Customers often highlight the company’s efficient claims process.

Importance of Customer Service and Claims Handling

Customer service and claims handling are crucial aspects to consider when choosing an auto insurance provider. A company with excellent customer service can provide assistance and guidance when needed, while efficient claims handling ensures a smooth process in the event of an accident or damage.

Researching and Comparing Auto Insurance Companies

- Read customer reviews and ratings to get a sense of the overall satisfaction level with each insurance company.

- Compare coverage options, deductibles, and limits to see which company offers the best protection for your needs.

- Obtain quotes from multiple insurers to compare pricing and discounts available. Remember to consider any additional fees or charges.

- Contact each insurance company directly to ask questions and clarify any doubts you may have about their policies and services.

Discounts and Savings on Auto Insurance

When it comes to auto insurance, finding discounts can help you save a significant amount of money on your premiums. Many auto insurance companies offer various discounts that can help lower your overall costs. Let’s take a look at some common discounts and tips for maximizing savings on auto insurance.

Safe Driver Discounts

Safe driver discounts are often offered to policyholders who have a clean driving record with no accidents or traffic violations. By maintaining a safe driving history, you can qualify for lower insurance rates and save money on your premiums.

Multi-Policy Discounts

Multi-policy discounts are discounts that you can receive when you bundle multiple insurance policies with the same insurance provider. By combining your auto insurance with other policies such as home or renters insurance, you can often receive a discount on all of your premiums.

Student Discounts

Many auto insurance companies offer discounts for students who maintain good grades, typically a B average or higher. By providing proof of good academic standing, students can qualify for lower insurance rates and save money on their premiums.

Bundling Insurance Policies and Safety Devices

By bundling your insurance policies with the same provider and installing safety devices in your vehicle, such as anti-theft devices or airbags, you can often qualify for additional discounts on your auto insurance. These measures not only enhance the safety of your vehicle but also help reduce your insurance costs.

Tips for Maximizing Discounts

- Regularly review your policy to ensure you are taking advantage of all available discounts.

- Consider raising your deductible to lower your premium costs.

- Maintain a good credit score, as many insurance companies use this to determine rates.

- Ask your insurance provider about any available discounts that you may qualify for.

End of Discussion

As you wrap up this journey through the realm of auto insurance comparison, remember to stay informed, ask questions, and make the best decision for your unique needs. Safe travels on the road ahead!