Looking to shop for car insurance? Dive into this comprehensive guide that breaks down everything you need to know about finding the perfect policy to suit your needs. From researching options to understanding coverage types, we’ve got you covered.

Get ready to navigate the world of car insurance with confidence and make informed decisions that will protect you on the road.

Researching Car Insurance Options

When it comes to finding the right car insurance policy, researching different options is crucial to ensure you get the best coverage at the most competitive price. By comparing multiple insurance policies, you can tailor your coverage to fit your specific needs and budget. Here is a step-by-step guide on how to start researching for car insurance:

Step 1: Determine Your Coverage Needs

- Consider the type of coverage you need, such as liability, comprehensive, or collision.

- Evaluate your driving habits, such as how often you drive and the distance you cover.

- Assess any additional coverage you may require, like roadside assistance or rental car reimbursement.

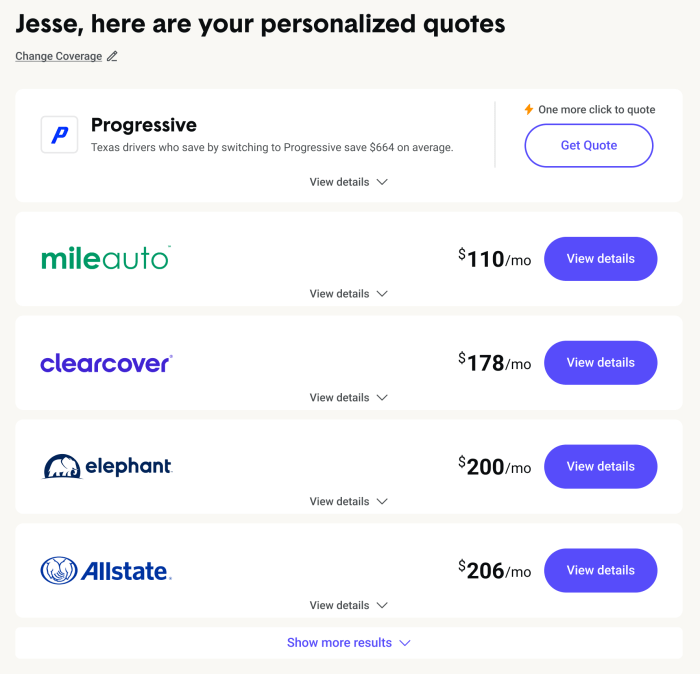

Step 2: Gather Quotes

- Get quotes from multiple insurance companies to compare prices and coverage options.

- Consider reaching out to an insurance broker who can provide quotes from multiple insurers.

- Ensure you provide accurate information to get the most precise quotes.

Step 3: Compare Policies

- Review the coverage limits, deductibles, and exclusions of each policy.

- Check for any discounts you may qualify for, such as safe driver discounts or bundling discounts.

- Consider the financial strength and customer service reputation of the insurance company.

By following these steps and considering the factors mentioned above, you can make an informed decision when choosing a car insurance policy that meets your needs and budget.

Understanding Coverage Types

Car insurance policies offer various types of coverage to protect you and your vehicle in different situations. It’s essential to understand the differences between comprehensive coverage and liability coverage to make an informed decision about your insurance needs.

Comprehensive Coverage vs. Liability Coverage

Comprehensive Coverage:

- Comprehensive coverage helps pay for damage to your car that is not caused by a collision, such as theft, vandalism, or natural disasters.

- It also covers damage from hitting an animal on the road or shattered windshields.

Liability Coverage:

- Liability coverage is required in most states and helps pay for injuries and property damage you cause to others in an accident.

- This coverage does not pay for damage to your own vehicle.

Examples of Situations Where Specific Coverage Types Are Beneficial

- If you live in an area prone to theft or vandalism, comprehensive coverage can help cover the cost of repairs.

- Liability coverage is crucial if you cause an accident that results in expensive medical bills or property damage to others.

- Comprehensive coverage is beneficial if you frequently drive in areas with a high risk of animal collisions, such as rural areas.

Factors Affecting Car Insurance Rates

When it comes to determining car insurance rates, several factors come into play. These include personal details such as age, driving record, and location, all of which can significantly impact the cost of your premiums.

Age

Age is a crucial factor in determining car insurance rates. Generally, younger drivers under the age of 25 tend to pay higher premiums due to their lack of experience on the road. On the other hand, older drivers, particularly those over 50, may qualify for lower rates as they are considered more experienced and less risky.

Driving Record

Your driving record plays a significant role in determining your insurance premiums. A clean record with no accidents or traffic violations can result in lower rates, as it demonstrates responsible and safe driving habits. On the contrary, a history of accidents or traffic violations can lead to higher premiums since it indicates a higher risk of future claims.

Location

Where you live can also impact your car insurance rates. Urban areas with higher traffic congestion and crime rates tend to have higher premiums compared to rural areas. Additionally, the frequency of natural disasters in your area can also affect insurance rates.

Ways to Lower Car Insurance Rates

- Maintain a clean driving record by following traffic laws and driving safely.

- Take defensive driving courses to improve your driving skills and potentially qualify for discounts.

- Bundle your car insurance with other policies, such as homeowners or renters insurance, to receive a multi-policy discount.

- Increase your deductible, which can lower your premiums but means you’ll pay more out of pocket in the event of a claim.

- Explore discounts offered by insurance companies for factors such as good grades (for students), low mileage, or safety features in your vehicle.

Utilizing Online Comparison Tools

When it comes to shopping for car insurance, utilizing online comparison tools can be a game-changer. These tools provide a convenient way to compare various insurance policies, prices, and coverage options all in one place, saving you time and effort.

Benefits of Using Online Comparison Tools

- Save Time: Instead of manually visiting multiple insurance company websites or calling agents, online comparison tools allow you to compare quotes instantly.

- Save Money: By comparing different policies side by side, you can find the best coverage at the most affordable rate.

- Easy Comparison: These tools provide a clear breakdown of each policy’s coverage, making it easier to understand what you’re getting.

- Customization: Many comparison tools allow you to input your specific needs and preferences, ensuring you get a policy tailored to you.

- Transparency: Online comparison tools offer transparency in pricing, helping you make an informed decision.

Reputable Websites for Car Insurance Comparison

- Insurance.com

- The Zebra

- Compare.com

- NerdWallet

- Insurify

Simplifying the Process

Online comparison tools simplify the process of finding the best car insurance policy by providing a centralized platform to compare multiple options. They streamline the research process, eliminate the need for multiple quotes from different providers, and empower you to make an educated decision based on your needs and budget.

Final Review

In conclusion, shopping for car insurance doesn’t have to be daunting. Armed with the right knowledge and tools, you can find the ideal policy that offers the coverage you need at a price you can afford. Stay informed, stay safe, and happy driving!